While overall smartphone demand remained flat compared to last year, 4G LTE smartphone demand across UK, Germany and France jumped significantly.

London, Hong Kong, Seoul, New Delhi, Beijing, San Diego, Buenos Aires –

Sept 7th 2016

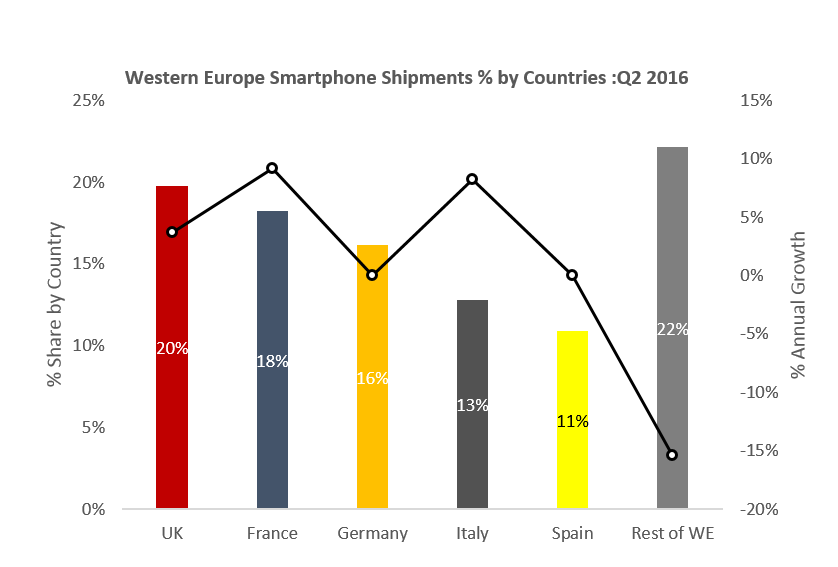

According to the latest research from Counterpoint’s Market Monitor service, smartphone shipments in the second quarter of 2016 in Western Europe declined 1% YoY and 8% sequentially. However the largest five countries grew 4% YoY but declined 6% sequentially.

Peter Richardson, Research Director at Counterpoint, commenting on Q2 2016 market and vendor performance said, “The overall smartphone demand remained soft during the quarter with upticks in demand in Italy (+8% YoY), France (+9% YoY) and UK (+4% YoY) offset by slowdowns in Spain, Germany and other smaller countries across Western Europe. However, 4G LTE smartphone demand grew a substantial 76% YoY, as most brands transitioned to an all LTE portfolio and operators continued to push LTE smartphone bundles across the region. The UK was the biggest market for LTE smartphone shipments during the quarter, followed by France and Germany. The UK also continues to drive the highest LTE subscription number in the region, reaching 40 million subscriptions at the end of Q2, led by the operator EE with a 41% share in the UK. The wave of LTE smartphone subscriber growth and the Q4 holiday season will drive the overall demand higher across Western Europe in the second half of this year”.

Tarun Pathak, Senior Analyst at Counterpoint Research, commented further, “Western Europe continues to be a market of strategic importance for many brands, not only from a volume perspective but also value perspective as it is one of the higher ASP markets in the world. As the smartphone market becomes increasingly saturated and growth is more and more driven by replacement demand, the mid-range to premium segment is going to be even more competitive in coming quarters. The brands with strong marketing campaigns, better product quality, and strong channel and operator partnerships will cement their position in the second half. Huawei and Apple should register positive growth in the second half of 2016, likely at the expense of Samsung and other Android brands such as LG, Sony, HTC and others. Aggressive Asian brands such as Oppo, Vivo, LeEco and Xiaomi remain elusive in Europe, the challenge is coming more from home-grown brands such as Wiko and BQ. However their share remains limited across the region as a whole.”

Market Summary:

- Almost nine out of every ten mobile phones shipped in Western Europe were smartphones

- Chinese brands contributed to almost a fifth of the overall smartphone shipments.

- One in five smartphones are sold through online channels.

- Almost nine out of every ten smartphones shipped in Western Europe were LTE capable.

- Top five markets contribute to almost 78% of the total smartphone market.

Exhibit 1: Western Europe Smartphone Shipments Contribution by Top 5 Countries

Source: Counterpoint Research Market Monitor Q2 2016

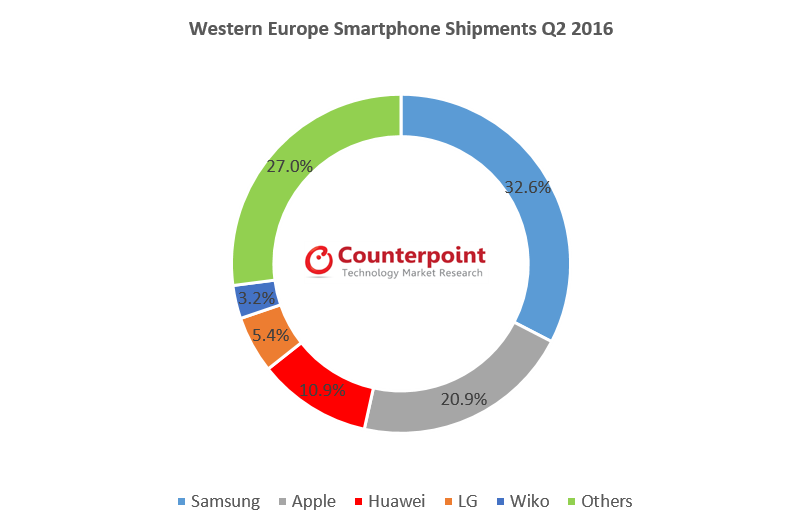

Vendor Summary:

- Samsung led the smartphone market during the quarter contributing a third of the total smartphone shipments in Western Europe driven by strong sales of its ‘A’ and ‘J’ series and flagship ‘S’ series.

- Samsung S7 series was among the Top Five bestselling models in each of the Top 5 countries.

- Apple maintained the second place with 21% market share in the region as shipments grew 5% YoY but were down 27% QoQ.

- Huawei was the third largest brand in the region with a market share of 11% with strong performance in markets such as Italy, Spain, Netherlands and the Nordics.

- Huawei shipments grew 30% YoY in the region driven mostly by strong demand of mid to high end smartphones

- Western Europe was one of the strongest markets for Huawei as it expands its distribution backed by a strong marketing campaign featuring Hollywood stars as brand ambassadors

- LG was ranked fourth in the region with a market share of 5% in the quarter driven by its K series. However, the recent flagship G5 failed to provide a much needed push in the premium segment.

- Wiko continues to be among Top 5 smartphone brands with a market share of 3% driven by a strong performance in the big markets like France, Italy, Spain and UK.

- Wiko was the third largest brand in France during the quarter as it remains popular in entry to mid smartphone segment.

Exhibit 2: Western Europe Smartphone Shipments 2Q 2016

Source: Counterpoint Research Market Monitor Q2 2016

The comprehensive and in-depth Q2 2016 Market Monitor is available for subscribing clients (here). Please feel free to contact us at analyst@counterpointresearch.com for further questions regarding our in-depth latest research, insights or press enquiries.

The Market Monitor research is based on sell-in (shipments) estimates based on vendor’s IR results, vendor polling triangulated with sell-through (sales), supply chain checks and secondary research.

Analyst Contacts:

Peter Richardson

+44 20 3239 6411

peter@counterpointresearch.com

Tarun Pathak

+91 9971213665

tarun@counterpointresearch.com

Follow Counterpoint Research

analyst@counterpointresearch.com

The post 2Q 2016: Western Europe 4G LTE Smartphone Shipments Grew 76% Annually appeared first on Counterpoint Research.